Disclosure: Any links to Wise in this post are affiliate links. That means if you click them and sign up, we can get a commission at no extra cost to you!

Jump to the Wise vs PayPal comparison

Why we chose Wise as a South African Small Business

We work remotely and benefit from working with international clients. At the moment, our clients are made up of businesses and entrepreneurs from countries like the United States, Canada, the United Kingdom, Australia, New Zealand and of course, South Africa.

However, accepting payments from international clients as a South African business has always felt way more difficult than it needed to. This is largely due to the fact that Stripe doesn’t work in South Africa, which we thought was the only payment integration with every platform we would ever want to use. We can accept international credit cards through platforms like PayFast, PayGate or PayPal but the fees add up quickly and sometimes the integration just isn’t there!

Enter Wise, previously Transferwise: The payment software that allows you to send/receive money via international bank transfers.

We were hesitant at first but decided that we could afford the sign-up fee and, if successful, it would pretty much be covered by the savings we made during our first transfer through Wise.

Signing Up and Getting Started with Wise

We made a free business account — you can sign up here.

Our first concern was that once the money was in the Wise account from a client we wouldn’t be able to ‘withdraw’ it to our local South African bank account.

We contacted their support and were quickly put through on their live chat to Ajay, who was extremely helpful and shared some more resources about ZAR, USD, and more international transactions that put our concerns at ease. You just EFT yourself the money, who’d have thought?

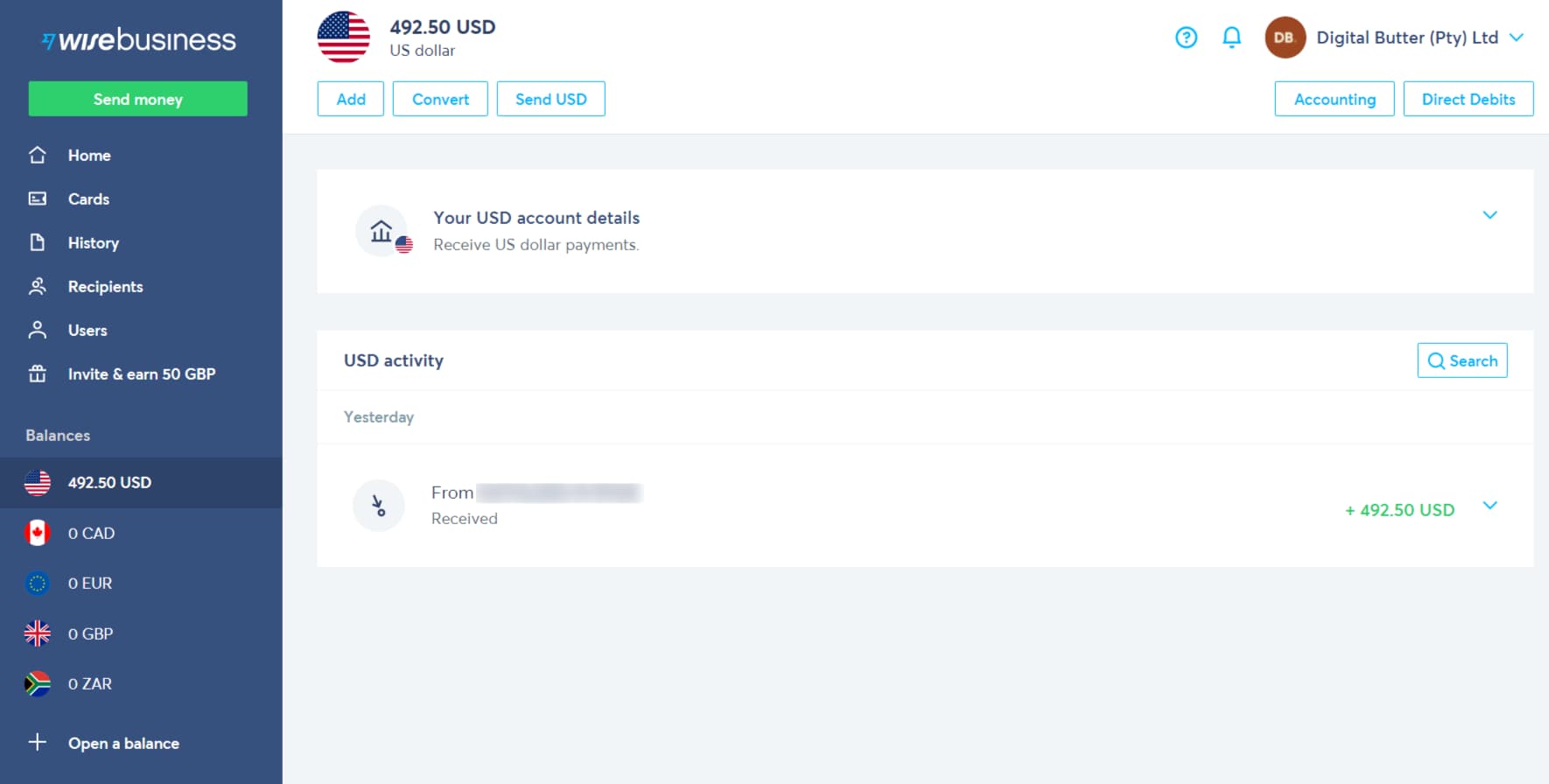

After creating the account there are some default currency account balances to get you started like GBP and EUR but we straight away opened up a USD and CAD — the two main currencies we wanted to accept from clients.

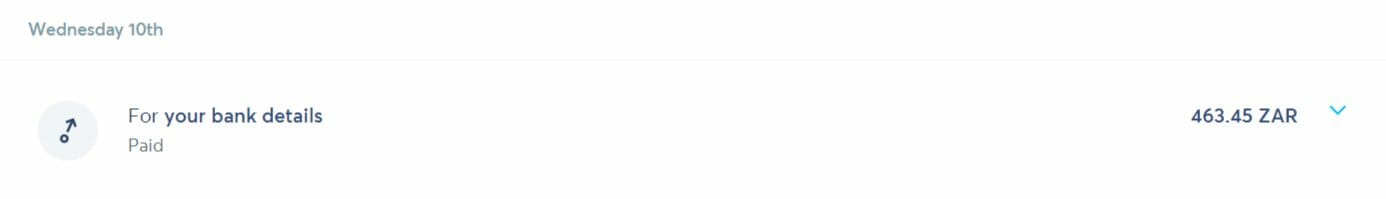

We made the once-off payment of R463.45 to ‘get account details’ for our USD balance but after making that one payment you can easily open balances in as many currencies as you want.

We had to verify some business information which included uploading copies of our (mine and Robyn’s) South African ID’s as we are both directors of Digital Butter.

The account details were verified almost instantly but the verification to open the other currency balances took about 2 business days.

Getting Paid By International Clients

We have accepted payments from the following locations:

- United States into our USD balance.

- Switzerland into our EUR balance.

- United Kingdom into our GBP balance.

- New Zealand into our NZD balance.

Here’s how it worked with a US payment.

- We sent an invoice with the Wise USD Account Details.

- The client pays via EFT/Bank Transfer (we paid a fixed fee of $7.50 for this transfer because the client chose to do a wire transfer. If they had chosen an EFT/Bank Transfer or any type of transfer that used the ACH routing number provided by Wise, there would have been zero fees at this point).

- The money (minus the fixed wire transfer fee) shows in our USD balance on Wise. They say payments take between 2–3 business days but the client let us know they had paid and just over 2 hours later it reflected in our Wise USD balance.

- Now to get the money into your South African business bank account, you click on “Send Money”.

- Choose the currency we want to send from (in this case USD) and the currency we want to send to (ZAR).

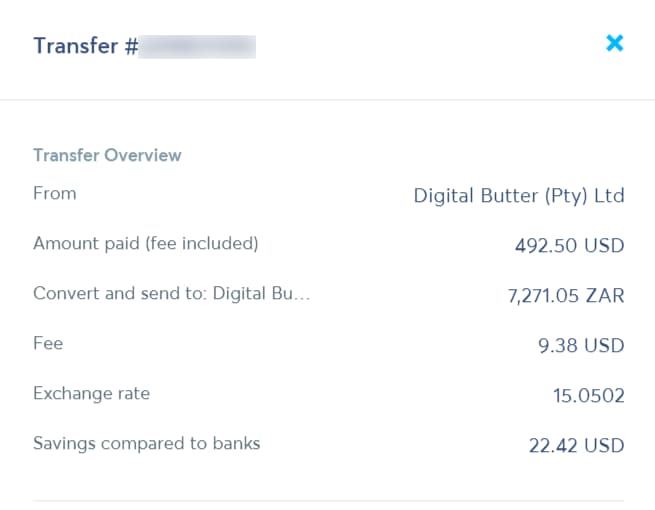

- The fees and conversions for this $500 transaction were:

- Initial $7.50 wire transfer fee.

- Exchange Rate provided: R15.0237 = $1 (9pm, Thu 25 March 2021)

- $9.40 for Wise’s variable % transfer fee (they have to make money somehow)

- After the transaction was complete, not sure how this worked but, we ended up actually getting a better exchange rate of R15.0502 AND the variable fee was 2c less at $9.38

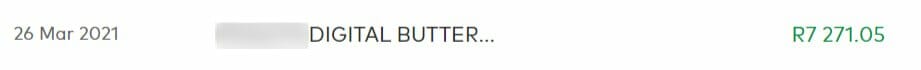

We ended up with R7,271.05 in our account.

We’ll compare this transaction with a PayPal transaction we did for the same amount at the same time in a moment. Spoiler— we got R304.50 more with Wise!

Wise said the money should arrive in our ZA business bank account within 3 days, however, it arrived the next day.

The same transaction with PayPal

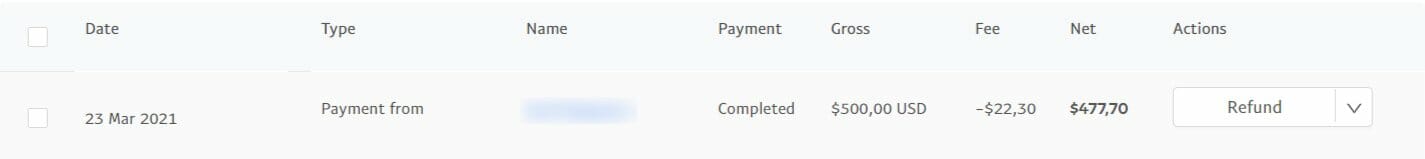

With PayPal, for a $500 invoice paid on the same day, the initial fee was $22.30

- Initial $22.30 wire transfer fee ($14.80 more than Wise)

- Exchange Rate provided: R14.7849 = $1 (9pm, Thu 25 March 2021— the exact date and time that Wise gave us a better exchange rate)

- FNB then takes a commission of the converted ZAR amount, this time it was 1.36% which equates to $6.50

We ended with a total of R6966.55 in our bank account when using PayPal and FNB to accept a payment.

That’s R304.50 less than we got when we used Wise.

Make the Wise Choice

Excuse the pun, but considering that we received more money for the same transaction on the same date when we used Wise, it’s safe to say that sticking with Wise is the wise thing to do.

From our experience, Wise is the cheapest and fastest method of receiving international bank transfers we have used to date. Having tried a range of other methods this is by far the best and most user-friendly option we’ve come across for a South African business. If you’d like to sign up and get Wise, here’s the link again.